With thousands of cryptocurrency tokens tradable on exchanges, and thousands more registered as ERC20s, confusion is inevitable. Many share extremely similar names and some have identical abbreviations. On Wednesday, one token pumped by 300% after a group of traders mistakenly bought it, thinking they were purchasing a different asset entirely.

Also read: Canadian Multinational Bank BMO Blocks Cryptocurrency Transactions

The Cryptoconomy Is Drowning in Tokens

The number of different tokens in existence is debatable, with estimates ranging from a couple of thousand to over 80,000. All that can be agreed on is it’s a lot, and the number is mushrooming with every passing month. Coinmarketcap lists over 1,500 coins and tokens, there’s another 12,000 that have launched on the Waves platform plus more than 68,000 tokens that exist on Ethereum. Most of these latter tokens haven’t launched, but their mere creation via smart contract is enough to sow confusion. There are 20 ERC20 variants of the petro alone.

On Wednesday, Suppoman, a Youtuber with over 140,000 subscribers, shilled Matrix Network (MAN), prompting many of his followers to rush off and buy the token. Unfortunately, several of them bought the wrong coin and mistakenly snapped up Matryx (MTX). As a result, MTX, which has a market cap of just $15 million, soared in price by 300% before rapidly correcting once investors realized their error.

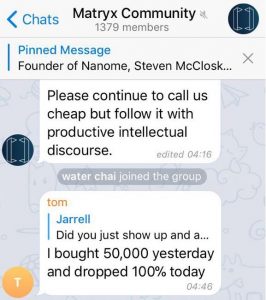

“Suppoman shills Matrix and his ever-so-bright viewers pumped Matryx instead,” laughed Crypto Jack, another popular Youtuber, reading out comments from his Telegram channel. “I bought 50,000 [Matryx] yesterday and [it] dropped 100% today,” complained someone in the Matryx Telegram group. This wasn’t the first case of mistaken token identity and it won’t be the last.

Too Many Tokens, Not Enough Tickers

The most confusing tokens of all aren’t those with similar names, but those with identical tickers. When bitcoin cash launched, some exchanges listed it as BCC, but others went with BCH because bitconnect already traded under BCC. In the end, BCH stuck, unlike bitconnect which didn’t stick around for much longer.

The most confusing tokens of all aren’t those with similar names, but those with identical tickers. When bitcoin cash launched, some exchanges listed it as BCC, but others went with BCH because bitconnect already traded under BCC. In the end, BCH stuck, unlike bitconnect which didn’t stick around for much longer.

As Vitalik Buterin pointed out, the number of available cryptocurrency codes is limited to just over 17,000. For ICOs trying to find an unclaimed abbreviation, this presents a problem. Their options are either to pick a long but unique name such as Ethorse (HORSE) or hope that their project will dwarf the existing coin with the same abbreviation. Coinmarketcap lists Bitcoin Lightning (BLT), for instance, alongside the better known Bloom (BLT), coins which were listed within 10 days of one another in January.

In some respects, the race for coveted three-letter abbreviations is much like the race for domain names during the dot-com boom. Many of the several thousand tokens in existence won’t survive, and a good few have fallen by the wayside already. They remain, though, on sites such as Coinmarketcap as a reminder of the abbreviation they once claimed. Until these tokens are officially declared dead and delisted, they will continue to cause confusion.

Have you ever gotten mixed up due to tokens that share the same abbreviation? Let us know in the comments section below.

Images courtesy of Shutterstock, Coincodex, and Telegram.

Need to calculate your bitcoin holdings? Check our tools section.

The post Token Overload Is Causing Confusion appeared first on Bitcoin News.

Powered by WPeMatico