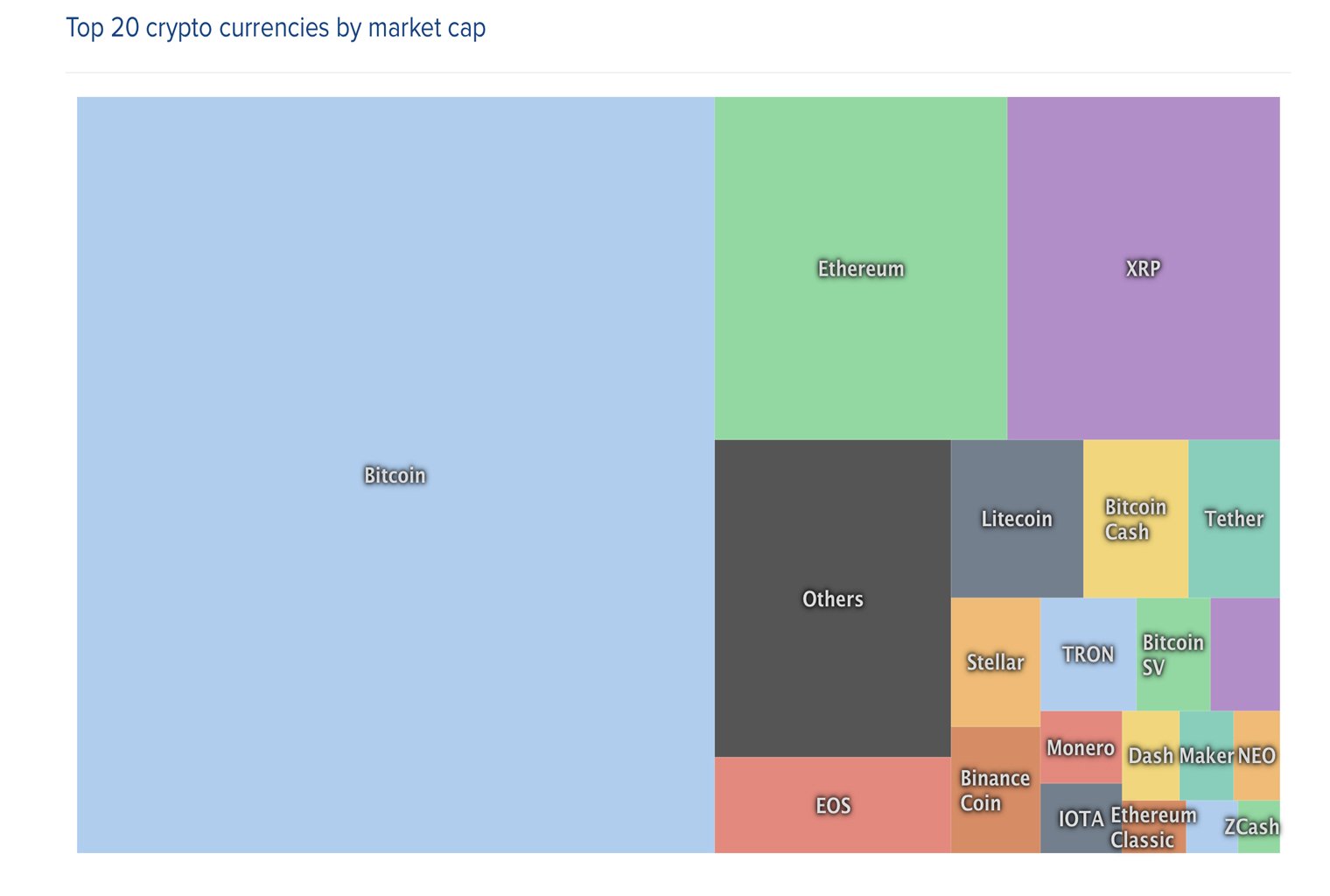

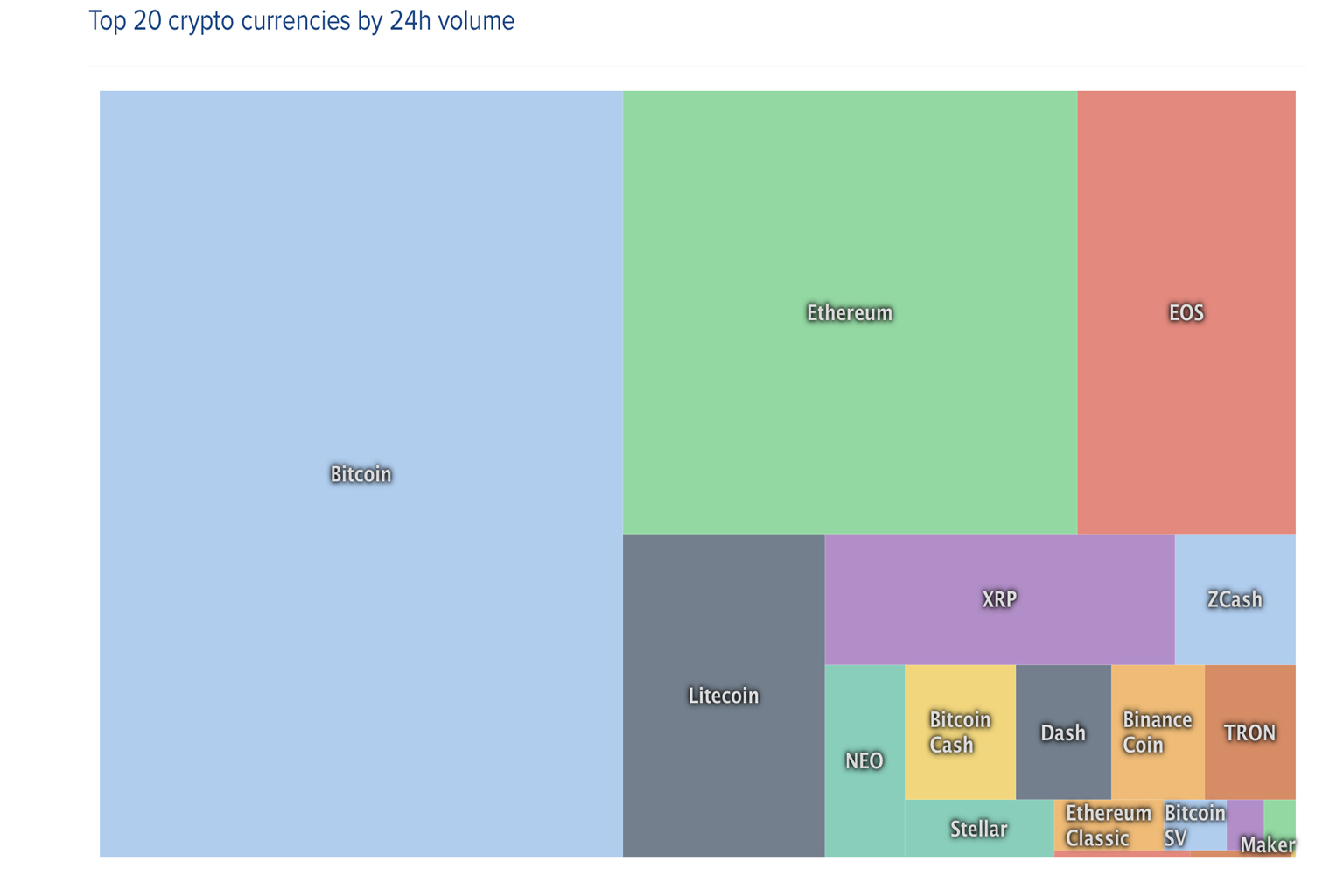

Over the last few days, cryptocurrency markets have been holding steady and consolidating after the correction on Feb. 24. Currently, the entire market capitalization is hovering around $129 billion and trade volume has started to diminish slightly with $24.9 billion traded over the last 24 hours. The top contenders capturing most of today’s daily gains consist of litecoin (LTC), binance coin (BNB), and ethereum classic (ETC).

Also Read: Public Transportation Across Argentina Can Now Be Paid With BTC

Crypto Markets Consolidate While Traders Wait for the Next Big Move

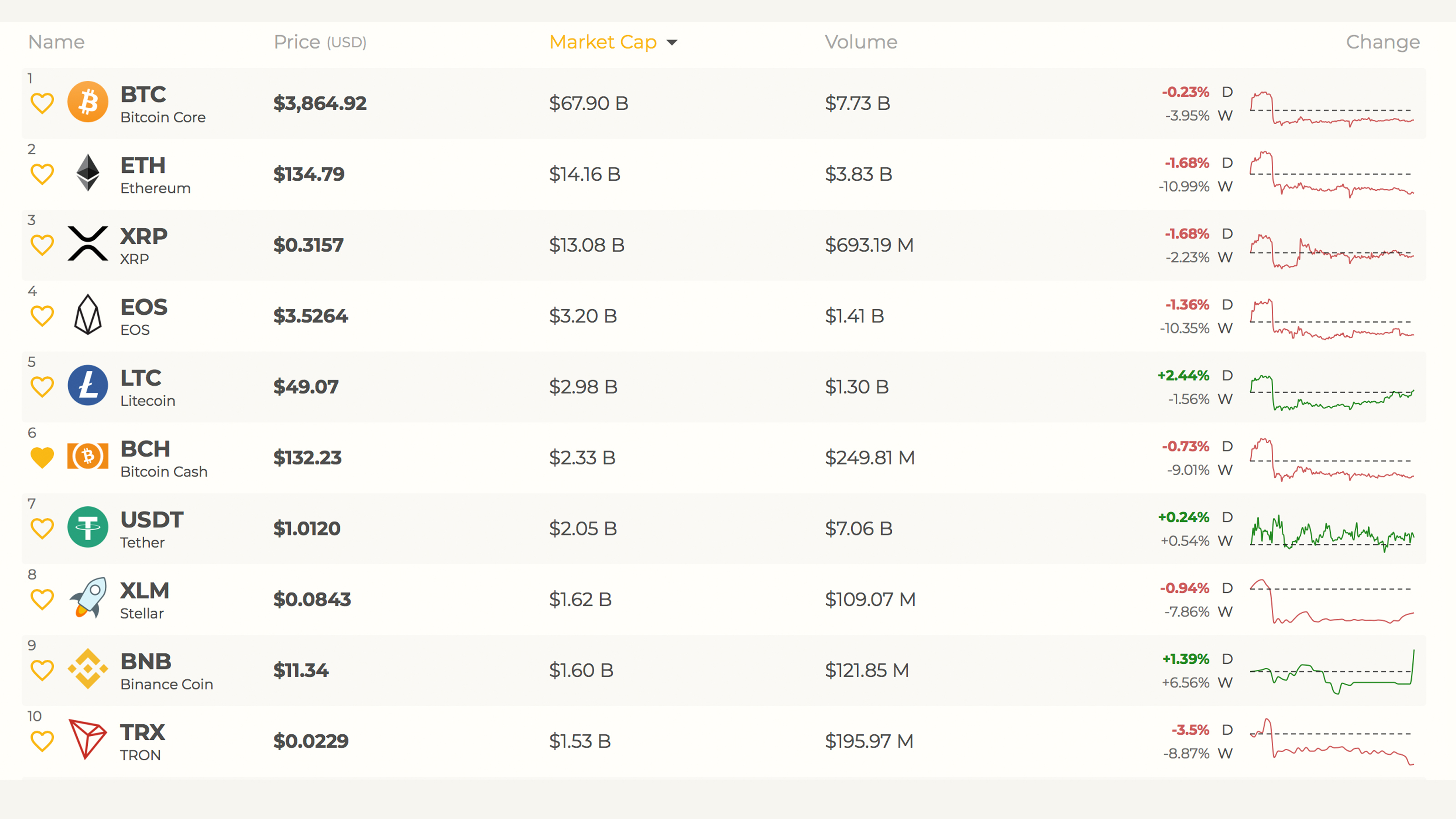

On Saturday, March 2, the most popular crypto markets have been dull after the last big price dip that took place last week. Today the three coins swapping the most volume are bitcoin core (BTC), tether (USDT) and ethereum (ETH). At the moment BTC is swapping for $3,864 per coin and has an overall market valuation of $67.9 billion. This is followed by the second largest market valuation held by ethereum (ETH) which is trading for $134 per token.

Ethereum had been the rally leader about a week and a half ago but markets are down over 10% for the week. Ripple (XRP) currently holds the third position today and each XRP is swapping for $0.31 a coin. This is followed by eos (EOS) markets which are down 10% over the last seven days as well. One eos is trading for $3.53 this Saturday and the market has an overall valuation of around $3.2 billion. Lastly, litecoin (LTC) is leading the top five markets by gaining 2.4% over the last 24 hours. One LTC is trading for $49 and markets have only lost 1.56% last week.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) markets are down this Saturday 0.73% and down over 9% in the last seven days. BCH is trading for $132 at press time and has a market capitalization of around $2.33 billion. This weekend BCH is the eighth most traded coin, below neo and just above dash.

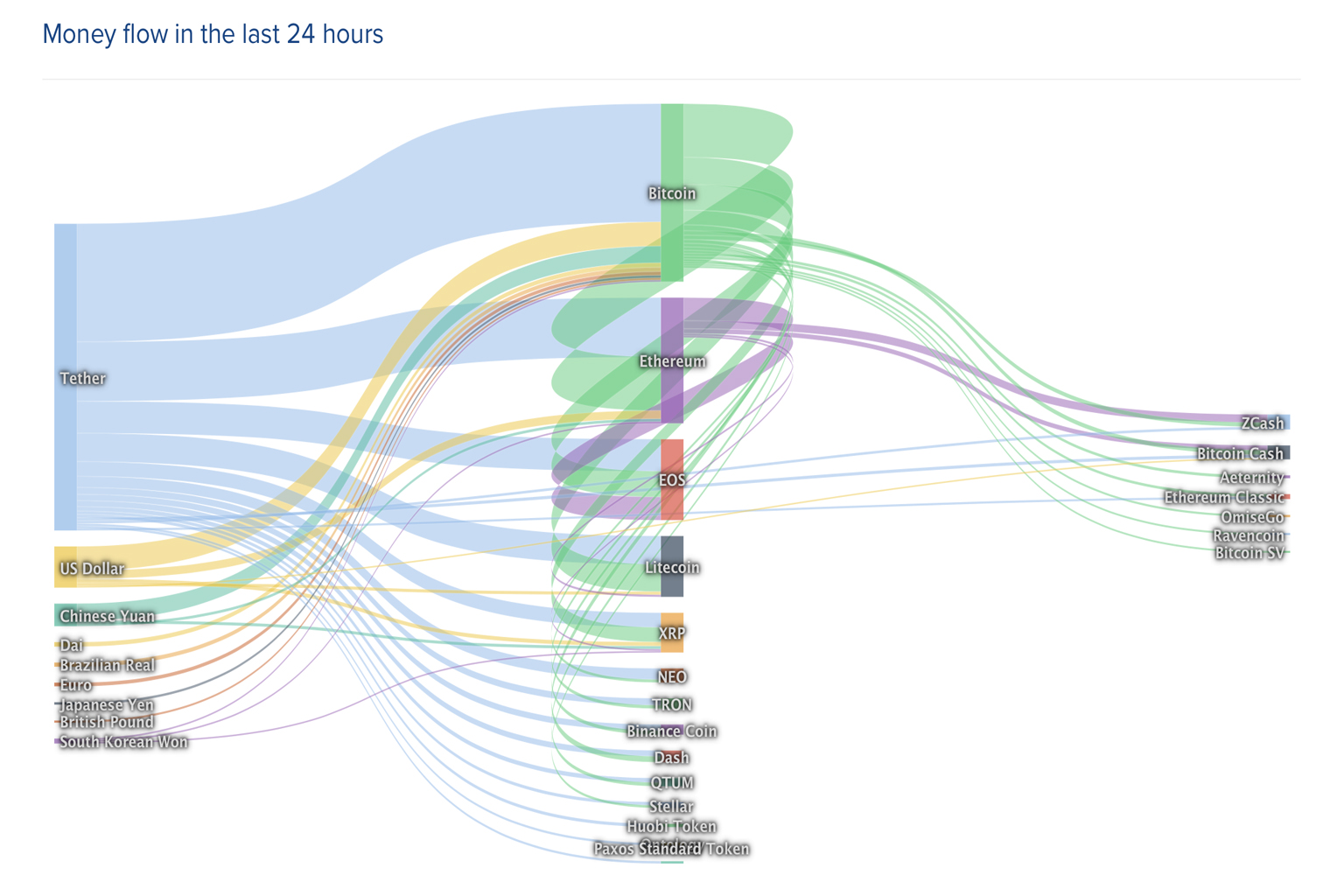

Currently, there is $249.6 million worth of BCH swapped among the most popular exchanges and ETH is capturing 43% of that volume. Pairs following ETH’s dominance with BCH include USDT (31%), BTC (16.5%), USD (4.3%), KRW (3.3%), and JPY (0.4%). The top five exchanges trading the most BCH this weekend are Lbank, Bitmart, Binance, Fcoin, and Bibox. Last week, before the Feb. 24 dump, BCH failed to break upper resistance above $145 per coin and foundations have been meandering around $128-135 since then.

BCH/USD Technical Indicators

Looking at the four-hour chart on Kraken and Bitstamp shows that even though there was a slight correction last week, things still look optimistic. An indicator that’s been revealing this trend is the fact that while BCH has been consolidating, the short-term 100 Simple Moving Average has crossed the long-term 200 trendline. This shows that the path toward the least resistance at least for now is toward the upside. BCH did spike above the $128 zone after the quick drop and the consolidation has reinforced a bullish outlook.

However, Relative Strength Index and Stochastic oscillators are meandering in the middle, showing indecisiveness among traders. Yet the MACd histogram shows room for improvement and it could start ascending after some resistance is broken this weekend. Order books still show that upper resistance is still around the $145 zone and from there, seas are much smoother. On the backside, if bears take the reins again they will be stopped between the current vantage point and $110.

The Verdict: Public Interest Is Waning But New Money May Not Be Needed to Ignite Next Bull Run

Overall traders are still uncertain, but a good portion think crypto markets may be near the elusive bottom. There are a few signals from both technical charts and overall positive news that could spark a price jump, although the month of March is well known for being a lackluster trading month for cryptocurrencies. Another obstacle is the fact that interest is waning as Google trends show that people searching for terms like “bitcoin price” “bitcoin” bitcoin cash” “ethereum” and “cryptocurrency” just isn’t happening as much as it was a year ago.

This gives investors the indication that “new money” just isn’t coming in, however, some analysts believe this doesn’t matter. For instance, the Singapore-based Three Arrows Capital CEO Su Zhu says there’s enough money sitting in crypto right now to initiate a price spike.

“There’s an estimated $2 billion in cash sitting in crypto funds. There’s another $2 billion+ sitting in stablecoins, and another $2 billion sitting at exchanges, silvergate, signature,” Su Zhu explained to his Twitter followers.

Zhu added:

This is $6 billion in fiat already onboarded to crypto to buy your bags — Imagine thinking we need new money to hit $10k.

Another indicator of positivity is the amount of bitcoin short positions dropping extremely low on exchanges like Bitfinex and Bitmex. The same can be said of ethereum short positions as a few weeks ago they reached all-time highs, but have since reversed considerably. These signs indicate that traders are uncertain the price will be heading lower and are waiting for the next big move for better insight.

Where do you see the price of BCH, BTC, and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Coinlib.io, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Diminished March Trade Volume Mirrors Previous Patterns appeared first on Bitcoin News.

Powered by WPeMatico