Cryptocurrency markets have been consolidating after a few volatile spikes and subsequent dumps over the last few weeks. Now a lot of crypto-traders are uncertain what will happen next, but quite a lot of people are showing pessimism by betting against cryptocurrencies like BTC with short positions. At the moment, BTC/USD short positions on Bitfinex are slowly approaching the all-time high that took place this past April.

Also read: Testing the Newly Transformed Non-Custodial Coinbase Wallet

BTC/USD Shorts Stack Up

Last April, BTC/USD short positions on Bitfinex reached a high of over 40,000 and now market shorts are climbing awfully close to that all-time high this August. At press time, there are 39,039 shorts on Bitfinex which means one of two things will happen — Either the price will drop downwards following suit with the bear’s predictions, or the bulls are playing a trick and the price will spike upwards very quickly in a very fast short-squeeze. People who are shorting BTC/USD believe and are betting the price will go down in the near future.

Long positions on Bitfinex are less than shorts at the moment, but not too much lower as there are 25,895 longs today on August 21. Traders playing long positions hope the BTC/USD price will replicate the action that took place last April when the price spiked fast and many got squeezed.

Waning Spot Volumes and a Lot of Money in Tether

There are two things that are also weighing heavily on traders: the lack of trade volume these days, and the amount of money in tether right now. BTC/USD trade volume has dropped significantly over the last few months and is around $3.7B over the last 24 hours. The lack of volume makes people leery of betting on a major rally as some traders think there’s not enough push to prime another bull-run.

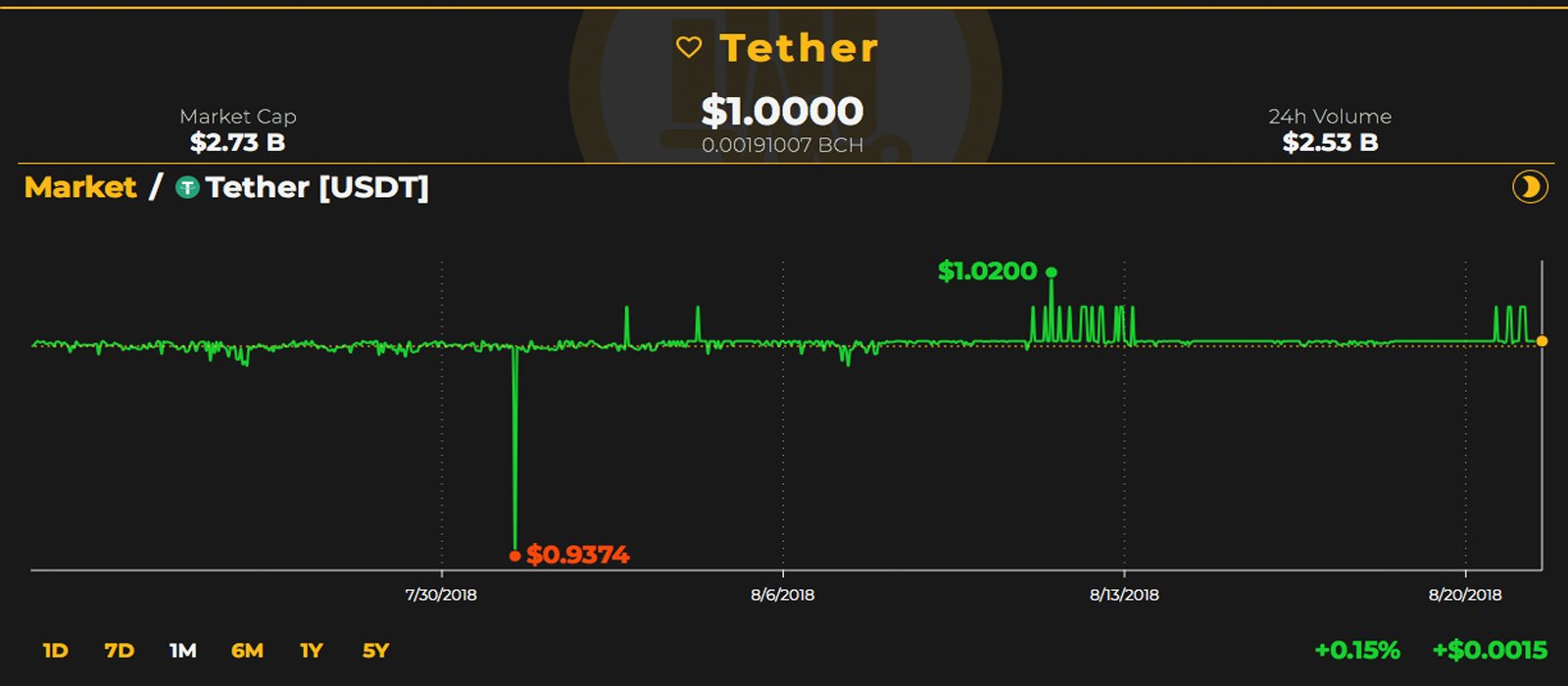

However, the large amounts of funds in tether (USDT) right now gives people the reason to believe all that money will flow back into cryptocurrencies. Tether does have a lot of money as the currency now holds the 8th largest market capitalization amongst every coin on August 21. USDT has a market valuation of around $2.7B right now and optimistic traders believe a large portion of that money will be back soon.

Leveraged Betting Increases Exponentially as Traders Hope They Made the Right Choice

Additionally, leverage trading on exchanges that allow traders to bet short or long has grown exponentially over the past two months. Exchanges that offer these trades, like Bitfinex and Bitmex, have seen significant trades volumes. Bitfinex is the third largest trading platform by volume today on August 21, with $280M USD worth of BTC swapped over the last 24 hours. Another example is the leverage trading platform Bitmex, which traded 1,041,748 BTC on July 24 shattering records by hitting a daily trade volume over $1B USD. Bitmex touched another volume high again by swapping 1,027,214 BTC on August 8.

This week markets have been a lot less volatile which is giving everyone the impression that something will change shortly, especially with all the shorts stacking up over the last seven days. BTC/USD prices are hovering above the support zone, the rough region where most traders believe is BTC’s bottom ($5,800). Either the bulls will get rejected and the support zone gets tested again or they surpass current resistance and move back towards the $8K range. One thing is for sure, traders are betting on this outcome feverishly and hoping they made the right choice.

Where do you see the prices headed from here? Are you short or long? Let us know in the comment section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: BTC Shorts Approach Record Highs This Week appeared first on Bitcoin News.

Powered by WPeMatico