Cryptocurrencies started gaining significant mainstream attention in 2017 and speculation brought coin values to unseen levels, before quickly deflating. Now, after a decade, it seems this technology is entering a new era that can actually move past speculation to embrace real-world utility. The only way this feat will be accomplished, however, is by offering a complete mixture of accessibility, sensible transaction fees, and censorship resistance, as promised by proponents years ago.

Also Read: Bounties and Responsible Disclosure Bolstered Crypto Infrastructure This Year

Yellow Vested Gilets Jaunes and Bitcoin

10 years ago Satoshi Nakamoto released a very profound technological innovation that gave global users the chance to embrace economic freedom, no matter where they resided in the world. For decades, traditional markets and the global economy have been manipulated by the world’s banking cartels, which continues to exacerbate growing debt and runaway inflation. The people hurting from these financial crimes are citizens living in countries suffering from hyperinflation like Venezuela, Zimbabwe, Sierra Leone, and Turkey. Moreover, the nation state’s central banks and bureaucrats in every country have been conspirators to some of the worst financial crimes history has ever recorded.

Cryptocurrencies are the perfect tools of freedom for certain groups, individuals, and global movements. In France, many citizens recently took to the streets in yellow vests (some of which read “Buy Bitcoin”) in order to protest the government and banking system. The yellow vest movement is a grassroots protest that began demonstrations on Nov. 17 because of obscene taxes, rising fuel prices, and higher costs of living. Paris is notorious for its revolutionary uprisings and the French Gilets Jaunes have scared elite members of the Republic once again. Emmanuel Macron’s tax freeze did not appease the people and the mounting frustration has remained. Instead of spurring arrests and burning cars, the yellow vest movement could use a less dangerous form of protest and actually hit the banks where it hurts.

For instance, on December 9, the Bitcoin proponent and show host Max Keiser explained on Twitter that the protesters could induce a real French banking crisis by withdrawing funds and depositing them into bitcoin.

“My research indicates a 20 percent deposit withdrawal will trigger an unsustainable chain reaction resulting in a severe French bank crisis,” Keiser stated. “If every French person converted 20 percent of their bank deposits into bitcoin, French banks would collapse and a lot of bloodshed could be avoided.”

‘Bitcoin Is the Real Occupy’

The French are not the only ones feeling the oppression of devalued currencies and failing economies that have been manipulated by the central banking cartel and the ‘elected’ oligarchy. Seven years ago, a similar uprising in New York City’s Zuccotti Park got widespread attention, and these protestors dubbed themselves the Occupy Wall Street movement. Like the yellow vest movement, occupiers were pissed off about the financial inequalities and hoped the protests would enlighten people regarding social and economic injustices worldwide. Occupy was a big movement that managed to cover 951 cities across 82 countries worldwide. However, it also showed the world the massive power of the financial elite’s police state. The movement was quickly forgotten after tent cities were bulldozed and protesters pepper-sprayed on television. The massive amount of protestors could have actually demonstrated a deep financial blow to the 1 percent and the fascist bureaucrats. In fact, occupiers can still vacate Wall Street with a cryptocurrency that’s prepared for mass adoption.

The French are not the only ones feeling the oppression of devalued currencies and failing economies that have been manipulated by the central banking cartel and the ‘elected’ oligarchy. Seven years ago, a similar uprising in New York City’s Zuccotti Park got widespread attention, and these protestors dubbed themselves the Occupy Wall Street movement. Like the yellow vest movement, occupiers were pissed off about the financial inequalities and hoped the protests would enlighten people regarding social and economic injustices worldwide. Occupy was a big movement that managed to cover 951 cities across 82 countries worldwide. However, it also showed the world the massive power of the financial elite’s police state. The movement was quickly forgotten after tent cities were bulldozed and protesters pepper-sprayed on television. The massive amount of protestors could have actually demonstrated a deep financial blow to the 1 percent and the fascist bureaucrats. In fact, occupiers can still vacate Wall Street with a cryptocurrency that’s prepared for mass adoption.

In December of 2017, the Wikileaks founder and author Julian Assange explained to his Twitter followers an alternative currency was the best way to circumvent the status quo. At the time Assange stated:

Bitcoin is the real Occupy Wall Street.

Reliable Permissionless Settlement

Cryptocurrencies need to grasp the attention of not only yellow vest types and occupiers, but also ordinary citizens living in countries that suffer from hyperinflation. In countries like Venezuela, accessibility is key for people who need a tool that shelters them from economic hardships. We all know there are many other countries in dire straits and billions of unbanked people throughout the globe. The problem as it stands is that when one of these large groups of protestors or a whole country of unbanked citizens flocks to a blockchain solution, if it is not ready to be reliable, it will not be sustainable.

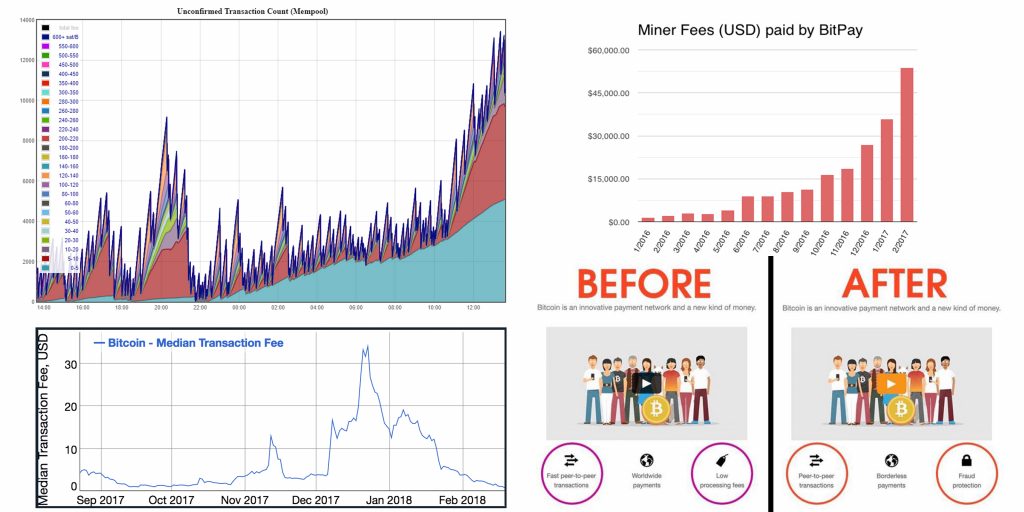

At the moment, there’s a wide variety of cryptocurrencies that provide a permissionless way to transact and offer some form of censorship-resistance for a small fee. Whether maximalists like it or not, these networks exist by providing a voluntary exchange in a manner unlike the traditional fiat system. Now, some form of hyperbitcoinization could very well happen if the decentralized currency dominates fiat, like Daniel Krawisz described in 2014. But after 10 years, that day is not here and the free market has yet to decide what decentralized coin will win or rule them all. The cryptocurrency that will be likely chosen by free market participants will provide low transaction fees in contrast to the fees back in December 2017 on the BTC network. One lesson history always teaches is that reliability should never be taken for granted.

If two thirds of the world cannot utilize the expensive fees on a blockchain network that provides permissionless settlement they will find another blockchain that will. After 10 years of spreading the gospel of bitcoin to the masses with an absolutely wretched UX, to think we will introduce another even less inviting UX like Lightning Network is absolutely absurd. The magnitude of the current network effect is already strong and it is not just with BTC. Ordinary people are learning about private keys and sending funds to alphanumeric addresses from a wide variety of blockchain systems in which the process is very much the same. Bitcoin cannot be the choice of the Sixth Republic of France, or for occupiers wanting to send a blow to the financial system if only certain users can afford the fees. Individuals will recognize an unfair system if it works like a Ponzi. If crypto tribalists think a person from Sierra Leone is going to use an unreliable network with sporadic fees that could eclipse the $1-5 of savings they want to spend at any given moment then maximalists have their heads in the sand.

The Free Market Has Not Chosen

Going forward in 2019, the cryptocurrency ecosystem will likely still be subject to speculation tied to the ecosystem, but over time, if people continue to be concerned about “Wall Street acceptance and Lambos,” this trope will get old pretty quick. I still believe Krawisz is correct that some type of hyperbitcoinization event will take place in the future and agree that it will be “much quicker than a hyperinflation event.” Furthermore, the recent mainstream article published by Time magazine and the economic freedom described is exactly why I and many others got into bitcoin in the first place. But the network that wins or rules them all will allow for global participation, and it will offer permissionless settlement and censorship resistance with sensible transaction fees.

When a hyperbitcoinization event takes place, it is then, and only then, that we will know who has won the technical and philosophical war. Until then, each and every crypto-infused free market construct must be ready for a hyperbitcoinization event. As for maximalists, they will be quite confused if their ‘precious’ is not ready when insatiable demand strikes, because free market participants will not wait for stubborn developers and another “18 months.” The free market does not care what tribalists think, as the maximalist thought process is a major source of objection to a free economy. As Milton Friedman stated: “[Free market constructs] give people what they want instead of what a particular group thinks they ought to want — Underlying most arguments against the free market is a lack of belief in freedom itself.”

What do you think about cryptocurrencies going forward in 2019 and beyond? Let us know what you think about this subject in the comments section below.

OP-ed disclaimer: This is an op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. The opinion editorial is for informational purposes only.

Images via Shutterstock, Daniel Krawisz, Bitcoin Not Bombs, and Twitter.

Have you seen our widget service? It allows anyone to embed informative Bitcoin.com widgets on their website. They’re pretty cool, and you can customize by size and color. The widgets include price-only, price and graph, price and news, and forum threads. There’s also a widget dedicated to our mining pool, displaying our hash power.

The post Embracing Utility in 2019: Unreliable Crypto Networks Will Lose to Hyperbitcoinization appeared first on Bitcoin News.

Powered by WPeMatico