IBM claims that six banks will issue stablecoins using its World Wire protocol which is based on the Stellar network. According to the tech giant, three banks have publicly committed to the initiative, and the remainder will reveal themselves soon. The announcement joins the resurgence of blockchain razzmatazz this year that feels eerily similar to the last time distributed ledger technology (DLT) was the cat’s meow back in 2016.

Also Read: Bitcoin’s Social Contract Must Be Resilient to the Whims of Future Generations

IBM’s Race to Remain Relevant: From the ‘Largest Commercial Uses of Blockchain’ to Private Banks Issuing Stablecoins

With JP Morgan’s newly announced coin and Digital Asset replacing Blythe Masters with new CEO Yuval Rooz, it seems blockchain hype is steaming up once again like a warm pile of cow manure. One prime example is IBM recently making headlines when it announced that six banks signed letters of intent to produce stablecoins using the IBM protocol called World Wire. The barrage of IBM’s meaningless blockchain announcements over the years shows the fervor with which the multinational tech firm has tried to remain relevant. A few people might recall the distributed ledger mania three years ago when IBM told the world it planned to launch “the largest commercial uses of blockchain” by September 2016, back when everyone was gaga for enterprise blockchains that have produced nothing but media puffery.

IBM Blockchain is just an overpriced, rubbish database used to get a rubber stamp from enterprises that want to be able to tell their investors they’re “blockchain enabled”.

Thank you for coming to my Ted talk.

— Riccardo Spagni (@fluffypony) March 20, 2019

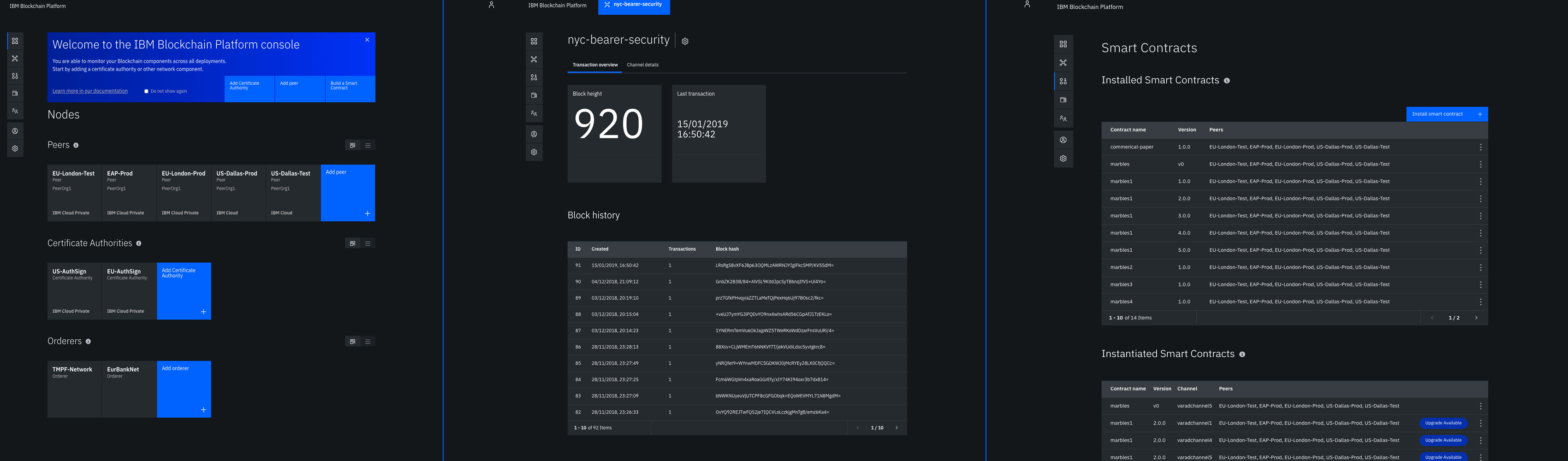

However, according to IBM’s vice president of blockchain technologies, Jerry Cuomo, and a slew of online publications, the system promised in 2016 was allegedly supposed to free some of the “$100 million in capital tied up at any given time in transaction disputes in the IBM Global Financing unit.” IBM even released a blockchain platform available for cloud developers that looks like a cheesy Javascript copy of the NXT blockchain with a quirky VS Code extension. IBM also started the Open Blockchain Initiative and worked with the Hyperledger project that year. But like the storm of Hyperledger announcements, R3 signing 60 banks, and projects like Citigroup’s ‘Citicoin,’ IBM’s largest commercial uses of blockchain seem to be all fluff. While public blockchains like BCH, BTC, and ETH have settled trillions of notional value in a permissionless manner we should probably ask: What have all these corporate blockchains done in the last few years?

Technobabble Blockchains With Zero Innovation

Now IBM is using the Stellar protocol and claims that the “IBM Blockchain World Wire makes it possible for financial institutions to clear and settle cross-border payments in seconds.” Reading IBM’s World Wire homepage is like having a horrible flashback to 2016, however, where it’s blockchain mania all over again. The usual reasons stated for utilizing IBM’s blockchain include lowering clearing costs, cheap cross-border payments, and the ledger reduces a lot of time. IBM’s website insinuates that unlike those crazy libertarian bitcoiners, the corporation is willing to work with the current financial incumbents.

“Bitcoin mania has led some to believe that banks are no longer needed for secure global money transfer — Banks, however, disagree,” explains IBM’s World Wire website.

Of course, the general population and even the media publishing IBM’s blockchain fluff pieces about their quest to secure the globe’s money transfer system only get a gist of what the company wants the public to see. As with most enterprise blockchain projects, it’s all closed door deals and the media gets a technobabble press release about some banks using the platform. Whether it be IBM, Hyperledger, R3, or JPM coin, there’s nothing exciting about these enterprise blockchain solutions. Yet we read about these vacuous initiatives every day in some of the most prominent crypto and financial news outlets.

Many of the projects are downright absurd, like when everyone got excited about Bumble Bee tuna products being verified on the blockchain. Private blockchain swaps and financial banks trading stablecoins add nothing new to the table: take away the fancy wrapped DLT packaging and all you’re left with is a generic database. Cryptocurrency advocate Andreas Antonopoulos composed a tweet in 2016 that encapsulated the blockchain hype at the time.

‘Major banks complete first international transaction using a blockchain’ — You mean, the same thing bitcoin has done several million times?” Antonopoulos mocked.

The bitcoin evangelist continued:

Correction: Banks paid consultants thousands to do once what bitcoin does for pennies every day, thousands of times, better.

Right now there are many projects that are permissionless and have an open ledger for everyone to verify. Just because a blockchain project is backed by traditional big name incumbents doesn’t give it an edge over public cryptocurrency systems that have been around for a decade. The DLT-embellished stories large tech companies like IBM and banks like JP Morgan churn out are little more than a feeble attempt to stay relevant.

What do you think about IBM’s blockchain attempts over the years and other well known corporations developing enterprise digital ledgers? Let us know in the comments section below.

OP-ed disclaimer: This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Image credits: Shutterstock, Twitter, IBM Cloud, and IBM logos.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post It’s 2019 and IBM Is Still Trying to Find a Use Case for Blockchain appeared first on Bitcoin News.

Powered by WPeMatico